Pricing & Commercial Models

Building competitive commercial models that maximise margin, strengthen customer value, and support sustainable growth.

Interested in pricing and commercial model design and would like to learn more about our expertise?

The problem we solve

Many companies struggle to translate their value proposition into pricing structures that defend margins, respond to the dynamics of their cost base, and support growth. Legacy pricing often lags behind market conditions, fails to reflect true delivery costs, or inadvertently creates incentives that erode profitability. Discounting becomes reactive, commercial terms lack discipline, and teams often rely on informal rules rather than a clear pricing strategy. In the worst case, deals that are won mask a race to the bottom on price.

Mid-market organisations in particular face increasing pressure from both enterprise customers demanding flexible models and competitors using aggressive or opaque pricing approaches. Without a commercially grounded model supported by sound governance, pricing becomes inconsistent, negotiation outcomes vary widely, and profitability fluctuates month to month.

Our approach

Auscorporate combines financial discipline, commercial pragmatism and sector insight to design pricing and commercial models that are operationally realistic.

Our work begins with a detailed assessment of a client’s cost structures, delivery, customer behaviour and go-to-market model. We consider market conditions, market positioning, competitive strategy, and work with clients to identify the unit economics that a pricing structure must deliver to meet their goals.

We then prepare a detailed commercial and financial modelling to identify potential pricing scenarios and project how they perform under real-world conditions. Through sensitivity analysis and scenario testing, we help our clients identify the impact of volume changes, discounting, cost escalation, and customer usage patterns. This approach provides clients with clarity on which pricing models enhance margin resilience and which create hidden exposure, ensuring that commercial decisions are made on a fully informed basis. Our approach to modelling draws on the skills of our CFO Advisory team and is relevant and defensible in a variety of settings, including SaaS pricing, professional services pricing, and manufacturing.

Our support extends through implementation, where we help clients embed pricing governance, approval thresholds and commercial workflows across sales, delivery and finance teams. By establishing the commercial operating model, we ensure the business can apply its new pricing framework with confidence, maintain contractual discipline and prevent margin erosion. Where required, Auscorporate can act as the pre-legal commercial interface for a client, translating strategic and financial logic into clear commercial positions for negotiation and contract documentation.

The result is a pricing approach that is strategically sound, operationally practical, and commercially defensible, providing organisations with a model that supports growth, communicates value, and delivers consistent margin performance.

Who we work with

Our clients come from diverse backgrounds and industries, seeking our support to solve unfamiliar commercial challenges or to augment their experience during critical periods of growth or transformation. Our Commercial Advisory team works with boards, executive teams, business owners, and entrepreneurs as they scale their businesses, negotiate major transactions, resolve disputes, or pursue significant strategic objectives.

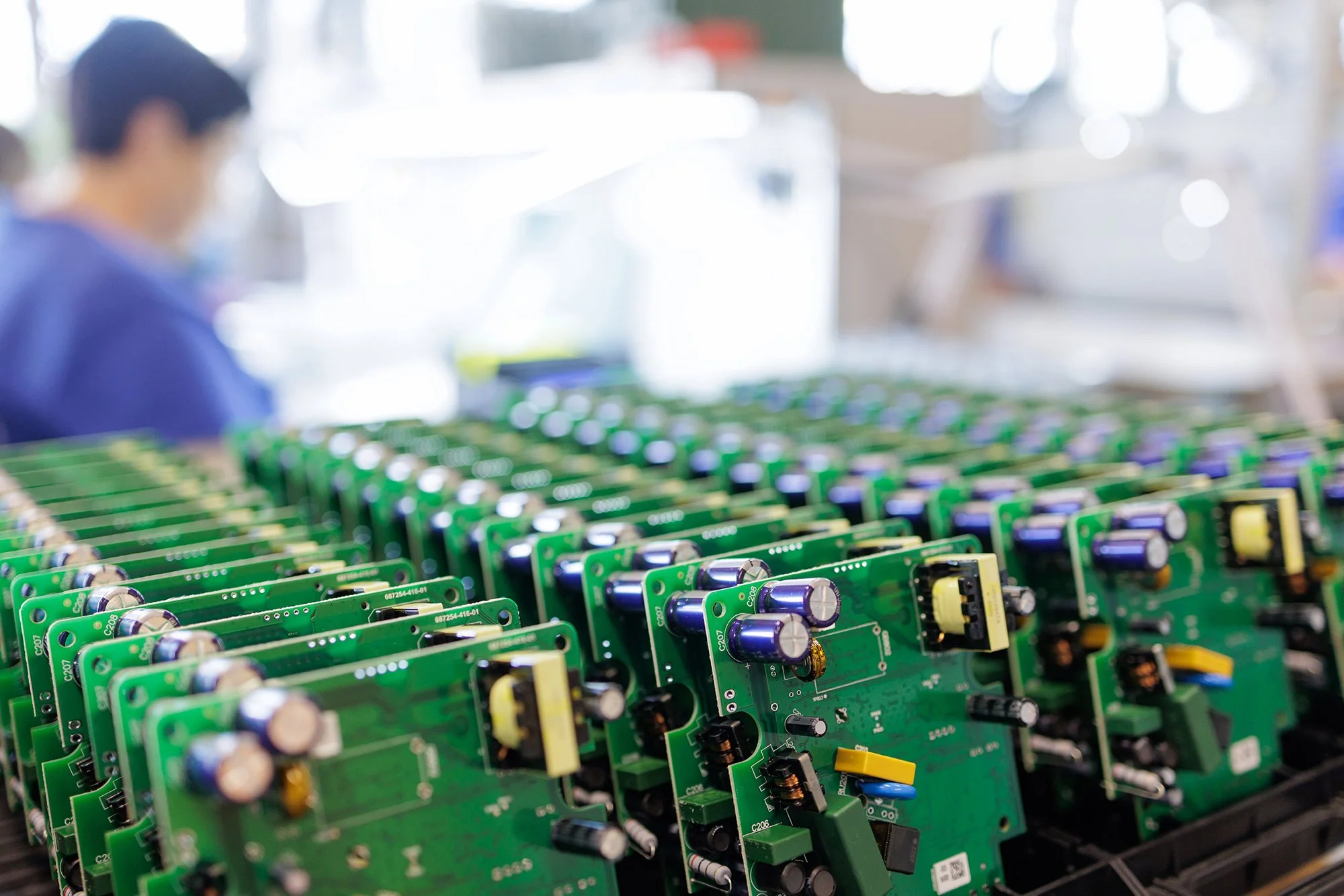

We work predominantly with mid-market companies, high-growth scale-ups and founder-led organisations generating between $2 million and $200 million in annual revenue. Our work spans sectors with meaningful regulatory, operational or commercial risk exposures, including technology, defence, government consulting, energy-adjacent markets, digital services, manufacturing, professional services and health.

What we deliver

We provide clients with clear, commercially defensible pricing frameworks that enhance margin reliability and mitigate negotiation risk. Our work ensures leadership teams understand the pricing levers available to them and the financial consequences of alternative structures.

Our deliverables typically include:

Cost-to-serve and cost-of-delivery assessments

Development of pricing structures (fixed, variable, hybrid, subscription, outcome-based, tiered, retainer, unit-based, or usage-driven)

Commercial model design aligned to customer behaviours and delivery economics

Margin and unit economics analysis

Discounting frameworks and commercial guardrails

Enterprise contracting pricing models (MSAs, SoWs, rate cards, indexed pricing, discounting structures, reseller and commission models)

Sensitivity testing and scenario modelling

Pricing governance frameworks

Why engage us?

Auscorporate brings executive-level commercial leadership, not academic frameworks or theoretical consulting negotiation models. Our capability is grounded in decades of direct responsibility for P&L performance, contract negotiation, customer lifetime value management, and commercial governance across various sectors, including technology, defence, national security, digital services, healthcare, hospitality, medical technology, and more.

We have operated within high-growth technology businesses, defence-aligned environments, regulated industries, multi-entity groups, and international delivery models across Australia, North America, Europe, and Asia. Clients rely on us because we combine financial discipline, market awareness, and practical judgement, helping mid-market organisations build pricing models that are both commercially effective and operationally realistic.

We are fully independent and unaligned with any deal outcome. Our focus is always on strengthening the client’s position, protecting value and embedding long-term commercial discipline.

Clients choose Auscorporate because we bring:

Deep commercial and executive-level experience in pricing, negotiation and margin management across complex, high-accountability sectors, including for listed public companies.

Proven capability managing sophisticated counterparties, including global technology firms, government agencies, industrial operators and enterprise customers and an understanding of how they view pricing.

Commercial judgement shaped by lived operational responsibility for P&L outcomes, not a theoretical observation or framework-driven consulting.

Independence and objectivity, we are unaligned to any deal outcome and solely focused on strengthening the client’s commercial position.

The ability to identify pricing risk, leverage, value erosion and margin exposure early, before they crystallise into commercial or contractual problems.

Expertise in translating pricing strategy into contract logic, commercial terms and operational rules that work in practice.

Case Studies

-

Case 1 | Value-Based Pricing Model - Medical Technology Client

A medical technology company developing a first-to-market emergency department application engaged Auscorporate to determine the most commercially effective pricing model for national hospital adoption. The client needed to understand how emergency departments operated, the cost structures underpinning triage activity and the comparative value their product delivered relative to existing processes. A traditional cost-plus or competitor-based pricing strategy was unsuitable because the product was unique in the Australian market and delivered operational efficiencies not captured by existing pricing methods.

Auscorporate undertook a comprehensive assessment of emergency department operations across Australia, drawing on hospital presentation data, average triage times, staffing requirements and salary benchmarks, including direct nursing and medical costs.

We modelled how improvements in triage efficiency, staffing utilisation and bed turnover created measurable operational value for hospitals. By stress-testing multiple scenarios, including variance in nurse salaries, presentation volumes, emergency bed capacity, and differences in state-based hospital structures, Auscorporate translated the client’s product benefits into financial metrics that could withstand procurement scrutiny. This included calculating per-presentation savings, annualised departmental savings and the commercial implications of feature sets that either preserved or diluted value.Our assessment enabled the client to adopt a structured value-based pricing model aligned to hospital economics rather than arbitrary price expectations. The model supported a transparent commercial narrative for hospital procurement teams, demonstrated quantifiable efficiency gains and positioned the product as a cost-saving operational tool rather than a discretionary technology purchase. For the client, this resulted in a commercially defensible pricing strategy and a scalable framework for national rollout.

-

Case 2 | Labour Pricing Model - Technology Services Client.

A national technology and professional services group engaged Auscorporate to design a defensible labour-based pricing model to support rapid growth in its Australian operations. The business was scaling its delivery workforce but lacked a consistent approach for determining sell rates, understanding margin impacts and assessing commercial viability when recruiting new employees or engaging contractors. Leadership needed a pricing framework that aligned to the company’s operating budget and profitability goals, while remaining practical for day-to-day use by non-financial managers.

Auscorporate developed an integrated labour cost and pricing model that enabled the client to calculate accurate sell rates across multiple engagement types — independent contractors, permanent employees and casual staff. Smart logic highlighted when proposed salaries or contractor rates would fail to meet margin thresholds or trigger award compliance risks, ensuring commercial discipline during recruitment and proposal stages.

The tool was intentionally designed as a practical pricing engine that could be used without financial expertise. Managers were able to input salary or contractor expectations and immediately understand the required sell rate to maintain target profitability. The model also supported scenario analysis, enabling leadership to test different salary structures, adjust operating budget assumptions and review the commercial impact of workforce mix decisions. This created a unified pricing approach across the company, reducing the risk of inconsistent or unprofitable engagements.The engagement provided the client with a clear, repeatable and commercially grounded pricing methodology that strengthened decision-making and improved financial outcomes. By embedding a disciplined pricing framework early in its growth trajectory, the organisation gained transparency over labour economics, improved its ability to forecast margins and established a scalable commercial foundation for future expansion

FAQs

What pricing models do you develop?

We build pricing models that range from fixed-fee, variable-fee, tiered, and scaling models to subscription-based, usage-based, retainer, and rate card models, all of which consider a company’s specific commercial objectives. Our pricing models can address a global market, a specific geographic area, or multiple countries; in other words, we develop models that meet the exact context in which they need to perform.

How do you ensure pricing is commercially defensible?

We consider cost structures, unit economics, market comparables, contractual obligations, and more to inform pricing that reflects real delivery costs, generating sustainable margins.

Can you assist in a cost investigation scenario?

Yes.

Do you replace our internal finance team?

We strengthen them.

We augment accountants, controllers, and bookkeepers — giving them structure, decision logic, and commercial interpretation — so the organisation gains control, visibility, and executive-grade reporting without the headcount cost of a full-time CFO.

You don’t need to replace your finance team to get assistance with pricing and commercial models.

Will your pricing withstand scrutiny from investors or the board?

Yes — that’s our benchmark.

Our pricing, modelling and decision frameworks are built for investor-grade review. Whether preparing for a capital raise, M&A, bank finance or board governance uplift, we ensure the numbers are explainable, defensible and strategically aligned

Do you have expertise in pricing complex products?

Yes. We have extensive experience preparing pricing models for complex manufactured products and complex services. Our experience spans pricing complex systems, as well as individual assemblies, down to the component level. On services, we have developed pricing models for services that follow the sub help desks, rely on field tech deployment capabilities and much more.

Do you work with Start-ups?

Yes. We regularly work with founders and early-stage teams to help them gain investor credibility by providing expert Commercial and CFO Advisory services, which include pricing and commercial models.

What we bring to a startup is deep experience in investor expectations, capital markets, commercial modelling and financial pragmatism.

We help founders strike the right balance between operating in a high-risk environment and capturing opportunities that are unique to an entrepreneurial context.

Can you help us evaluate the pricing we have been given by a supplier?

Yes. When building a commercial model, understanding the cost base for your product or service means understanding how supplier pricing and associated commercial terms work, input from suppliers, contractors, and subcontractors. We have significant experience in building commercial models that involve substantial supplier, contractor and subcontractor inputs.